Are you saving enough for your child’s education?

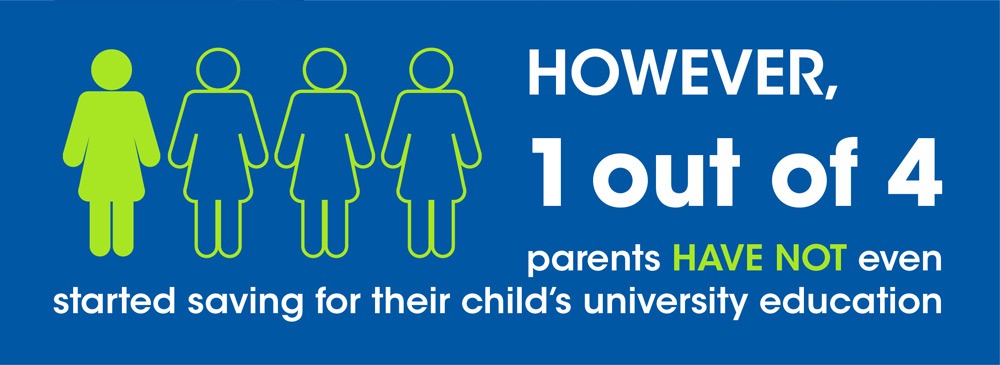

96% of parents in Singapore agree that education is their child’s passport to success in life. Yet, one out of every four parents have not started saving for their child’s college education. Are you one of them? This is how you should be saving smartly for your child’s fund.

American human rights activist Malcolm X once famously said, “Education is the passport to the future, for tomorrow belongs to those who prepare for it today.”

The world over, every parent dreams of giving their child a good education. There is no doubt in parents’ minds that this is the key to ensuring a bright future for their children. So, many of them start thinking quite early on about ways to save money for their children’s future.

Parents in Singapore are no different.

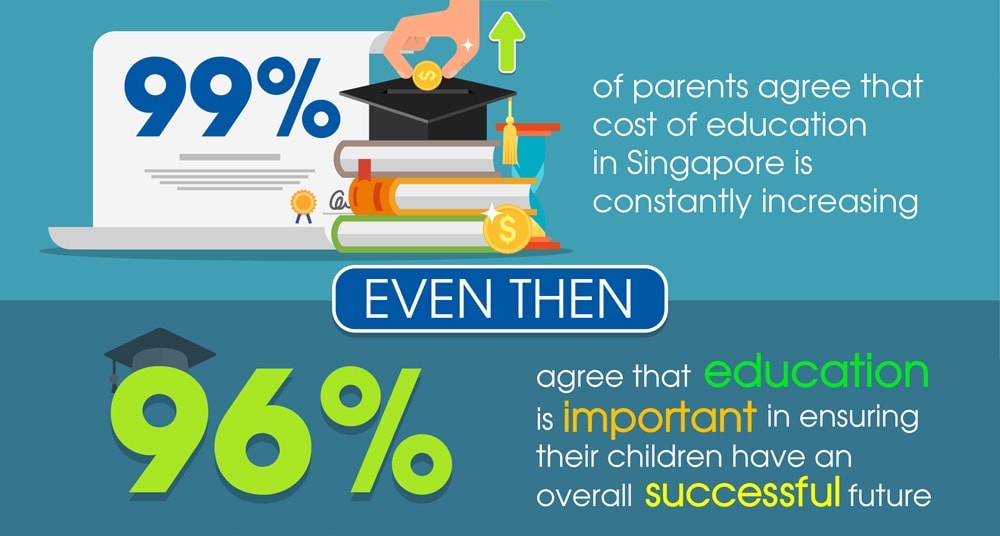

The Asianparent conducted a survey commissioned by dollarDEX in Singapore and found that 96% of parents here are convinced of the importance of education to secure their kids’ future.

The rising cost of education

In today’s world of financial volatility and uncertainties, the cost of education is rising, like all major services worldwide. In Singapore, a report by CNBC1 suggests that the cost of attending university has jumped 38% on average since 2007. The annual tuition fees for a general arts and science degree used to cost between S$6,000 to S$7,000 back in 2007. However, the same degree costs between S$8,000 and S$11,000 today, which is up as much as 51%. Similarly, at the Singapore Management University (SMU), the same degree cost S$7,500 in 2007, which was also the most expensive among the other local universities. Today, it is going to set you back by S$11,300 in SMU at a whopping 50% jump in fees.

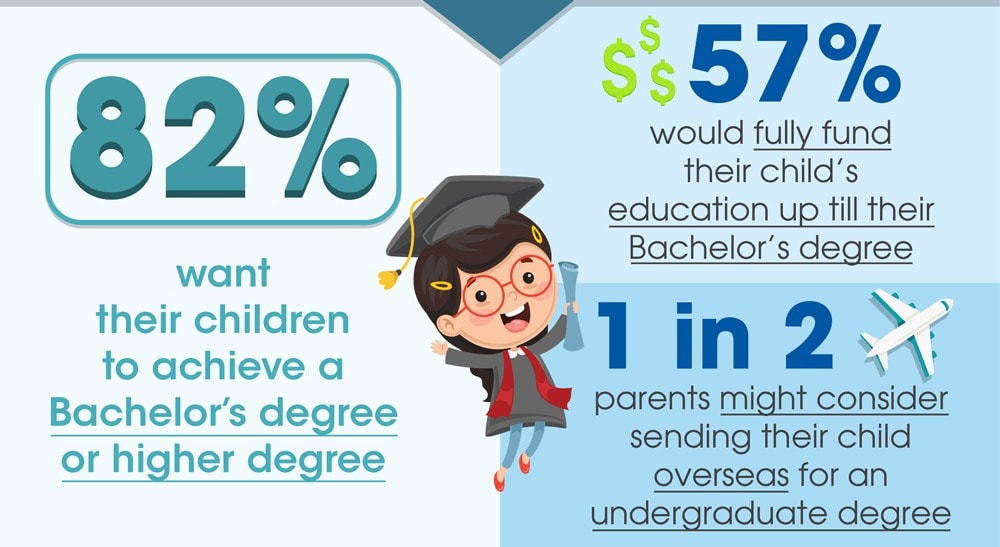

Despite these soaring costs, parents still want the best for their children, and most would prefer a bachelor’s degree or even higher for their children.

Of course, for your child to acquire at least a bachelor’s degree, the cost has to be borne either by you or your child, likely through a student loan or scholarship. While student loans may be common in Western countries, it is typical of Asian parents to shoulder this financial burden for their children.

Besides paying for the cost of tuition and living expenses for their children, some parents are also keen to explore overseas education in US, UK or Austraila where the quality may deemed to be higher.

Funding for your child’s university education is definitely not cheap, let alone sending them overseas for it. So, how is it possible to ensure you have sufficient funds to do so?

How much will you spend on your child’s education and what is a smart way to accumulate funds for it?

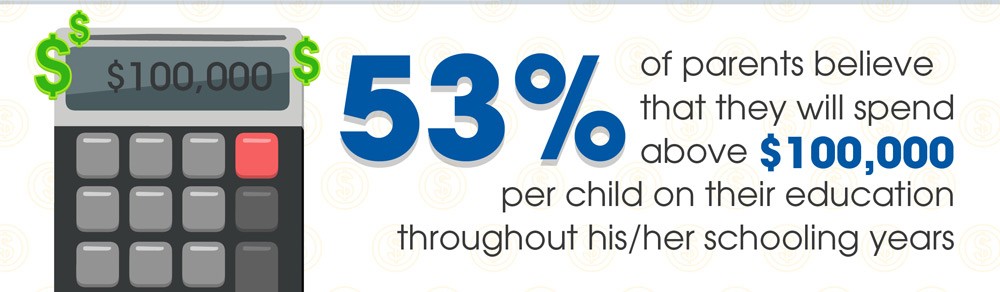

We all love our children and want to support in what they do, including their education. But when we do the math, the investment required is staggeringly high.

Here is an estimated breakdown of investment in education you will be making for your child in Singapore throughout their schooling years:

Primary and Secondary School education: S$2,136 for 14 years of studies in Government schools

Junior College: S$792 for two years of studies

OR

Polytechnic: S$8,700 for three years of studies

University degree: S$28,000 to S$146,750 (depends on the course of study)

For example, the tuition fee for NUS ranges between S$29,650 - S$146,750, depending on the course2.

If you project this 10-15 years from now, the costs will likely be even higher. Have you ever given it a thought and done the calculations? Here’s what other parents think.

Have you started saving for your child’s education?

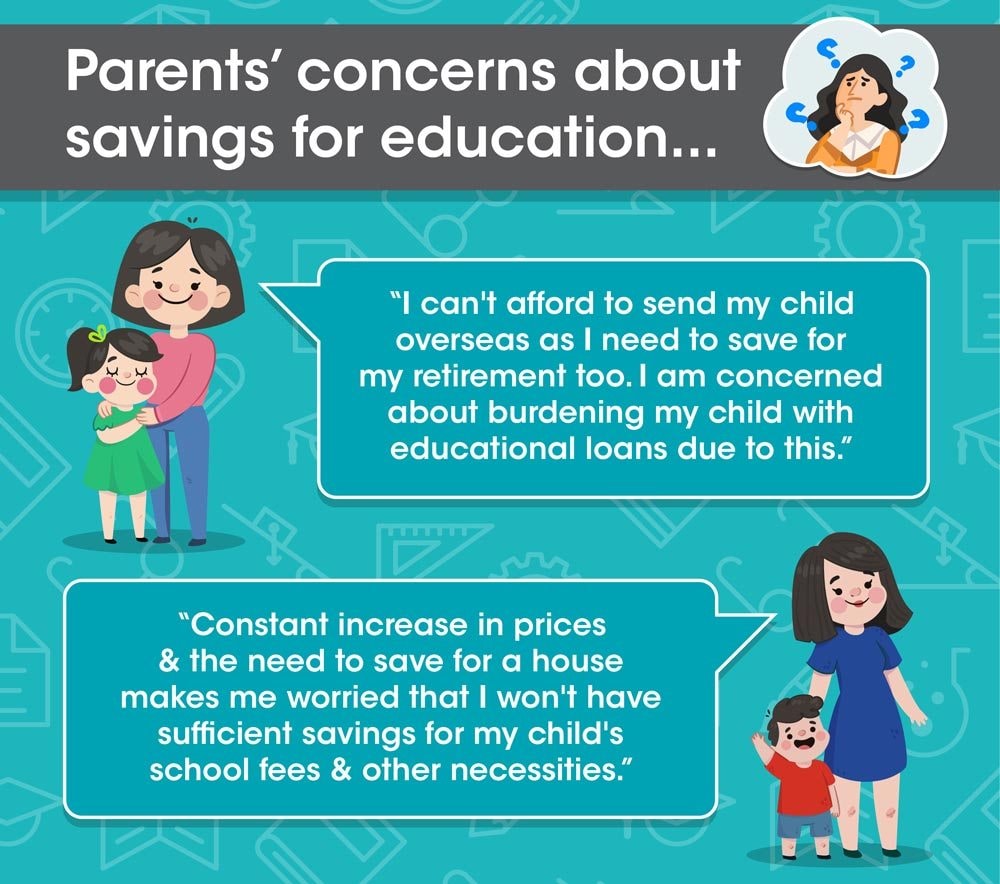

Paying for your child’s university education is probably one of your biggest financial concerns. There might be other competing demands on your income that disrupt your saving plans such as home mortgage, car loans, school and tuition fees, healthcare and travel costs.

Top 3 reasons why parents haven’t started saving for their child’s university education

Sometimes, parents have all the good intentions to save money for their child’s future education. However, they tend to delay saving for one reason or another. Here’s what we found out in our survey (please see the right hand side of the graphic image below, titled 'Top 3').

Top 3 ways to fund your child’s university education

So are you a procrastinator when it comes to saving for your child’s college education?

It’s time to be proactive! After all, it’s about your child’s future. You can plan to start saving as early as you can afford to. This can help reduce the burden on you in the future or your child so they won’t have to take up a student loan and helps them to remain debt-free.

To put this in perspective, one research has found that more than 52% of parents in Singapore are willing to go into debt to fund their child’s university education and is probably the biggest financial hit you will take, besides your property3. This makes it even more important for you to start planning for your child’s education much earlier!

So, what is a smart way to save money for your child’s university fund? While there are various financial instruments that can help you in this regard, choosing one is not easy, especially if you are not financially savvy.

Which product should you choose to save money for your child’s education? Should you just put your money in an ordinary savings account or should you go for a portfolio of stocks and bonds? What about an insurance policy that matures in the future? There are many options out there.

What’s more, they can be confusing with differing entry amounts, liquidity and maturity dates. It can all potentially lead to analysis-paralysis in parents!

Here’s the top 3 products that most parents are planning to use to save for their child’s university:

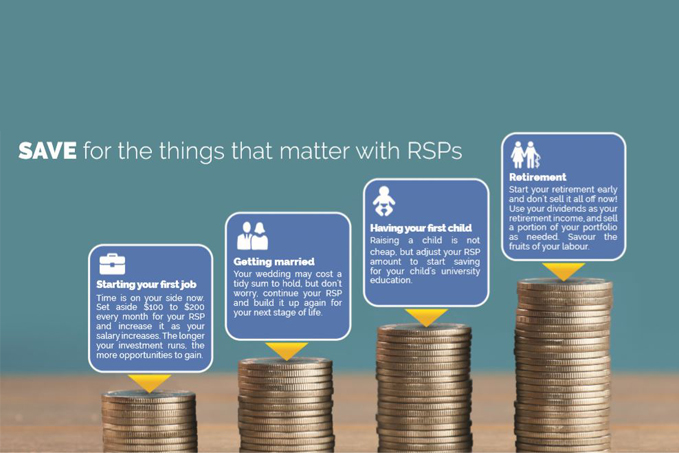

Different savings approaches at different stages of life

The act of saving for the future is dependent on what life stage you are in. If you are a young parent, you might think that you have plenty of time ahead to save for your child. Maybe your priority right now is to invest in a house.

Slightly older parents might be worried about saving for their retirement.

But it’s never too late...

The best approach for parents when saving money for their child’s education, is to have multiple engagements within the financial eco-system. This gives you a mix of different financial products with different maturity or liquidity to manage your future finances.

In other words, don’t put all your eggs in one basket by having a mix of insurance policies, cash in savings account, investments and even fixed deposits, depending on your needs.

Mums and dads, if you haven’t started saving for your little one’s future education, it is never too late to start now.

You just have to find the right plan that works for you.

Here’s a worry-free plan that can help you save for your child’s future education.

Why is this plan attractive for parents?

This plan suits parents who require flexibility, convenience and liquidity, which can all be done on dollarDEX, an online investment platform backed by globally renowned insurer Aviva.

The benefits include:

Liquidity: You can withdraw the money whenever you need it.

Low investment sum: Their Regular Savings Plan (RSP) is flexible for everyone including parents with commitments. You can invest starting from just $100/month, and increase along the way when you can afford to, or when you get a pay increment!

24-hour monitoring: You can log in 24/7 and carry out/monitor your investments at any time even when you are commuting home or after putting the children to bed.

No fees: Being parents, we tend to be cost-conscious and with dollarDEX, the best thing is that they allow anyone to invest at absolutely no charge of fees. The $100/month that you invest goes straight into the fund of your choice and dollarDEX does not take any cut from it.

Liquidity: You can withdraw the money whenever you need it.

So, dear parents, as you now know, investing in your child’s future education need not be complicated or require a lot of money to start. One of the best and smart ways to save money for this is to simply open an account with dollarDEX! You will be amazed to see and experience for yourself how easy and safe it is. And most importantly, you can start planning for the best possible higher education for your child.

Click here to start making plans for your child’s future!

VIEW FULL INFOGRAPHIC HERE

YOU MAY ALSO LIKE

1https://www.cnbc.com/2016/10/12/singapore-university-costs-rise-38-since-2007-with-law-degrees-increasing-the-most.html

2https://blog.bankbazaar.sg/average-cost-education-singapore/

3http://aspire.sharesinv.com/46813/3-crazy-facts-about-singapore-student-debt-now/

All information here is for GENERAL INFORMATION only and does not take into account the specific investment objectives, financial situation or needs of any specific person or groups of persons. Prospective investors are advised to read a fund prospectus carefully before applying for any shares/units in unit trusts. The value of the units and the income from them may fall as well as rise. Unit trusts are subject to investment risks, including the possible loss of the principal amount invested. Investors investing in funds denominated in non-local currencies should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not indicative of future performance. dollarDEX is affiliated with Aviva but dollarDEX does not receive any preferential rates for Aviva products as a result of this relationship. Unit trusts are not bank deposits nor are they guaranteed or insured by dollarDEX. Some unit trusts may not be offered to citizens of certain countries such as United States. Information obtained from third party sources have not been verified and we do not represent or warrant its accuracy, correctness or completeness. We bear no responsibility or liability for any error, omission or inaccuracy or for any loss or damage suffered by you or a third party (including indirect, consequential or incidental damages) arising in any way from relying on this information.

This information does not constitute an offer or solicitation of an offer to buy or sell any shares/units.

This article has not been reviewed by the Monetary Authority of Singapore.

Information is correct as of 05/10/2018.