5 ways to get more out of your SRS

With so many ways to plan for your retirement, using your hard-earned Central Provident Funds (CPF) is definitely not the only way. Ever heard of the Supplementary Retirement Scheme (SRS)? It may sound like a mouthful but don’t underestimate this powerful hack that is designed to enhance your retirement planning with attractive tax reliefs and tax-free gains on investments.

What is SRS?

For the uninitiated, the SRS is a voluntary scheme started by the Singapore government in 2001 to encourage Singaporeans, Permanent Residents & tax-paying Foreigners to save more for their old age by contributing a varying amount (subject to a cap) at their own discretion where contributions can be used for investments. It is designed to complement the mandatory CPF scheme and is operated by the three local banks; DBS, OCBC & UOB.1 Unlike your CPF funds, you can withdraw funds from your SRS account even before you reach the statutory retirement age should you need those money for any urgent or emergency needs.

Get income tax relief & tax-free gains on investments

The main reason why taxpayers in Singapore would contribute to their SRS is for its attractive tax benefit, which comes in the form of income tax relief. Currently, the maximum SRS contribution is $15,300 for Singapore Citizens and Permanent Residents, whereas for Foreigners, it is at $35,700. The best part is that your SRS contributions are also subject to a cap on personal income tax relief of $80,0001 per year!

Another benefit is that gains on your SRS investments are tax-free before withdrawal and only 50% of the withdrawals from SRS will be taxable at retirement.2

To find out how you can contribute or make withdrawals on your SRS, you may read more on the Ministry of Finance4 and IRAS2 website.

So what can you do with your SRS account?

The available options for SRS Investments are Fixed Deposit, Insurance, Unit Trusts, Shares, REITs & ETFs. Unit Trust has been an evergreen choice amongst SRS account holders since the scheme was first introduced, with a staggering $733 Million invested as of December 2017.5

If you are not sure how to start, here are five great ways to maximize your SRS by starting with Unit Trusts investing:

#1 Invest in a Money Market Fund

If you are a smart taxpayer that have been squirrelling money away in an SRS account over the years, good on you! However, do you know that the interest rate is at a nominal 0.05% per annum? So why not put your SRS into a stable and low risk instrument that could yield a range of 0.7% to 1% per annum such as the Singapore Money Market Fund?

You may read more about Money Market Funds in our earlier article or compare them through our Fund Finder.

#2 Build a Dividend Portfolio

If building passive income is your goal, look no further. At dollarDEX, we have over 250 dividend- paying funds and the yields of these funds range from a nominal 0.08% per annum to as high as 10.3% per annum. Investors can also choose funds with various distribution periods whether it is monthly, quarterly, semi-annually or annually. Additionally, there are also many asset classes and sectors to choose from depending on your preference.

Do take note, however, that dividends you receive will go back into your SRS Account and not in cash, which means that you can only start withdrawing at your statutory retirement age.

Find out how you can start building your dividend portfolio here.

#3 Consider a model portfolio for your risk profile

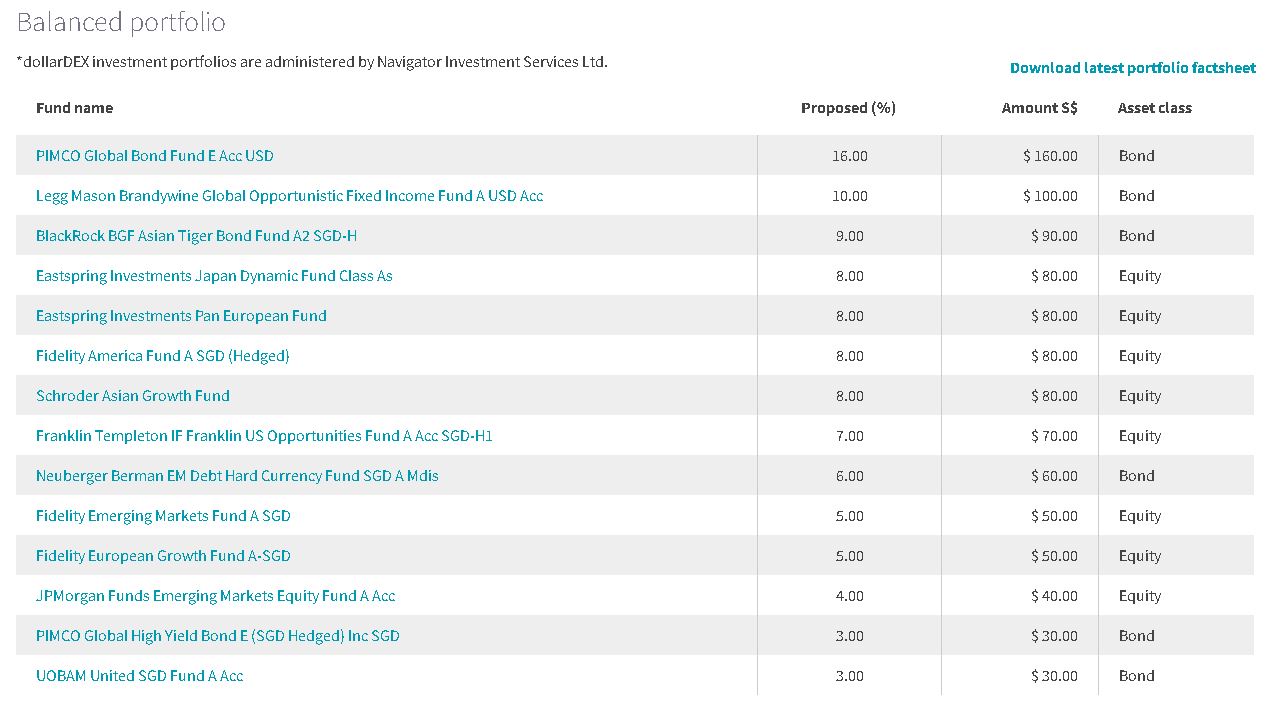

For investors who prefer a plug-and-play or “turnkey” investment portfolio constructed via research-backed investment theories, model portfolios do just that. At dollarDEX, we collaborate with Morningstar Research to create five model portfolios based on your corresponding risk profile.

The risk profiles range from Conservative, Moderate, Balanced, Growth and Aggressive. To find out what risk profile you belong to, simply create a dollarDEX account for free and complete our Risk Questionnaire.

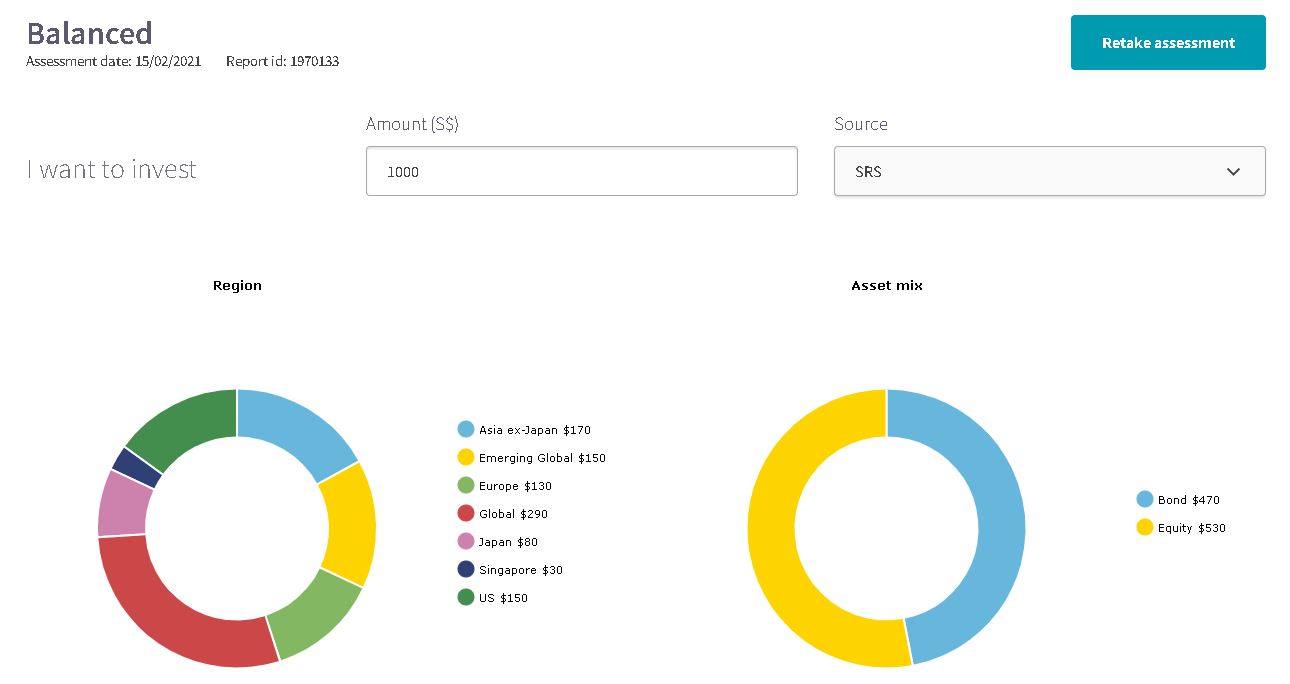

The diagram below shows a simulation of a $10,000 investment through SRS into a Balanced model portfolio. A typical Balanced portfolio usually consists of an estimated 50% in Equities & 50% in Bonds, which is then further broken down into various geographical regions based on the proposed weightage.

Click here to discover our portfolios.

#4 Invest in the market itself with Index Funds

Most fund managers exist to beat the benchmark and to deliver long-term returns for unit trust investors. With thousands of unit trusts available, the challenge for investors is to select the right funds to invest in so that they can outperform the market.

Consider including index funds as part of your core investment portfolio to help grow your retirement funds while adding on other actively managed funds into the satellite portion to boost your portfolio performance. This school of thought is echoed by legendary investor; Warren Buffett, and demonstrated in his famous $1 million bet against a hedge fund back in 2007.

Explore the list of Index Funds available on dollarDEX by using our Fund Finder and filter for index funds under the 'Advanced' tab

#5 Grow your investments steadily with a Regular Savings Plan

Contrary to popular belief, you do not need a huge capital to start investing. In fact, you can avoid market timing by starting a Regular Savings Plan (RSP) with as little as $100 a month.

When investors embark on dollar-cost averaging, they automatically buy more units when prices are low and fewer units when prices are high. This allows them to pay an average price for the total cost paid per unit in the long run.

You can perform a RSP using funds from your SRS for any of the investment strategies mentioned earlier, whether it is Money Market Funds, Dividend Funds, Model Portfolios or even Index Funds.

Start building your retirement funds with SRS today!

If you have yet to explore what you can do with your SRS, unit trusts offer you plenty of flexibility and choices. At dollarDEX, we want to empower investors by keeping your costs to a minimum and deliver a fuss-free investing experience. Opening an account is free, and you maximise your SRS investments further as we charge you absolutely zero sales charge, zero switching fee and zero platform fees. Create an account and start no-fees investing today!

Sources:

1. https://www.mof.gov.sg/MOF-For/Individuals/Supplementary-Retirement-Scheme-SRS

2. https://www.iras.gov.sg/irashome/Schemes/Individuals/Supplementary-Retirement-Scheme--SRS-/

3. https://www.iras.gov.sg/irashome/Other-Taxes/Withholding-tax/Foreigners-PRs-withdrawing-from-Supplementary-Retirement-Scheme/Tax-Obligations-for-SRS-Withdrawal/

4. https://www.mof.gov.sg/Portals/0/mof%20for/individuals/SRS_Booklet%20-%207%20Dec%202017.pdf

5. https://www.mof.gov.sg/docs/default-source/mof-for/individuals/srs/compiled-srs-stats-for-201780cc3a223716408aa8574e82f0c61dd3.pdf

YOU MAY ALSO LIKE

All information here is for GENERAL INFORMATION only and does not take into account the specific investment objectives, financial situation or needs of any specific person or groups of persons. Prospective investors are advised to read a fund prospectus carefully before applying for any shares/units in unit trusts. The value of the units and the income from them may fall as well as rise. Unit trusts are subject to investment risks, including the possible loss of the principal amount invested. Investors investing in funds denominated in non-local currencies should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not indicative of future performance. dollarDEX is affiliated with Aviva but dollarDEX does not receive any preferential rates for Aviva products as a result of this relationship. Unit trusts are not bank deposits nor are they guaranteed or insured by dollarDEX. Some unit trusts may not be offered to citizens of certain countries such as United States. Information obtained from third party sources have not been verified and we do not represent or warrant its accuracy, correctness or completeness. We bear no responsibility or liability for any error, omission or inaccuracy or for any loss or damage suffered by you or a third party (including indirect, consequential or incidental damages) arising in any way from relying on this information.

This information does not constitute an offer or solicitation of an offer to buy or sell any shares/units.

This article has not been reviewed by the Monetary Authority of Singapore.

Information is correct as of 01/11/2018.