|

Dollar value averaging: The superior cousin of dollar cost averaging 1 Nov 2020

How often have we heard cautious savers raise fears, concerns and objections to investing?

In a bull market, we will hear “Market is too high to invest right now!” and in a bear market, they will say “Market can still drop further, I want to wait for things to stabilize first before risking my hard-earned savings”

Some may add that “Investing is for the rich! Middle-class people like me don’t have money to invest” or that “Investing requires a lot of time, energy and effort to monitor the market, I don’t have time for that!”

Of course, there are merits to why these concerns are raised. It is after all their hard-earned savings. But what if there are time-tested solutions and strategies that could address these concerns?

Contrary to those beliefs, investing is not only for the rich, and it need not be time-consuming or stressful. What’s more, if you set in place the right strategies, it really doesn’t matter whether it is a bull or a bear market!

So, what are the strategies out there?

Strategy #1 – Dollar Cost Averaging through a Regular Savings Plan (RSP) Over the years, I’m sure that you have come across the term dollar-cost-averaging either through your financial adviser or on mainstream media. If you have not, do get yourself acquainted by reading our article “Dollar-cost averaging: How you can use a regular investment plan to grow your long-term wealth”

The idea behind dollar-cost averaging is simple. Instead of investing a large sum of money at one go, you would invest a smaller, fixed amount at regular monthly intervals over a medium to long term horizon. Doing so paves the way for investment discipline and eliminates the emotional and behavioural biases that fuel irrational trading activity by periodically making investments regardless of price movements within the market.

For instance, when the asset prices are high, the investor will be buying less units of a given asset with every dollar invested. At the same time, the investor scoops up more units of the same asset with every given dollar when market prices are subdued. This activity captures the essence of dollar-cost-averaging, as the prices of your purchases converge to a middle ground between your most expensive and cheapest trades.

A RSP allows you to kickstart your investment journey with a small sum of as low as $100 a month, and besides helping you to avoid market-timing investing behaviour (since predicting the future prices of where the stock market moves is anyone’s guess), it can be done at your own pace.

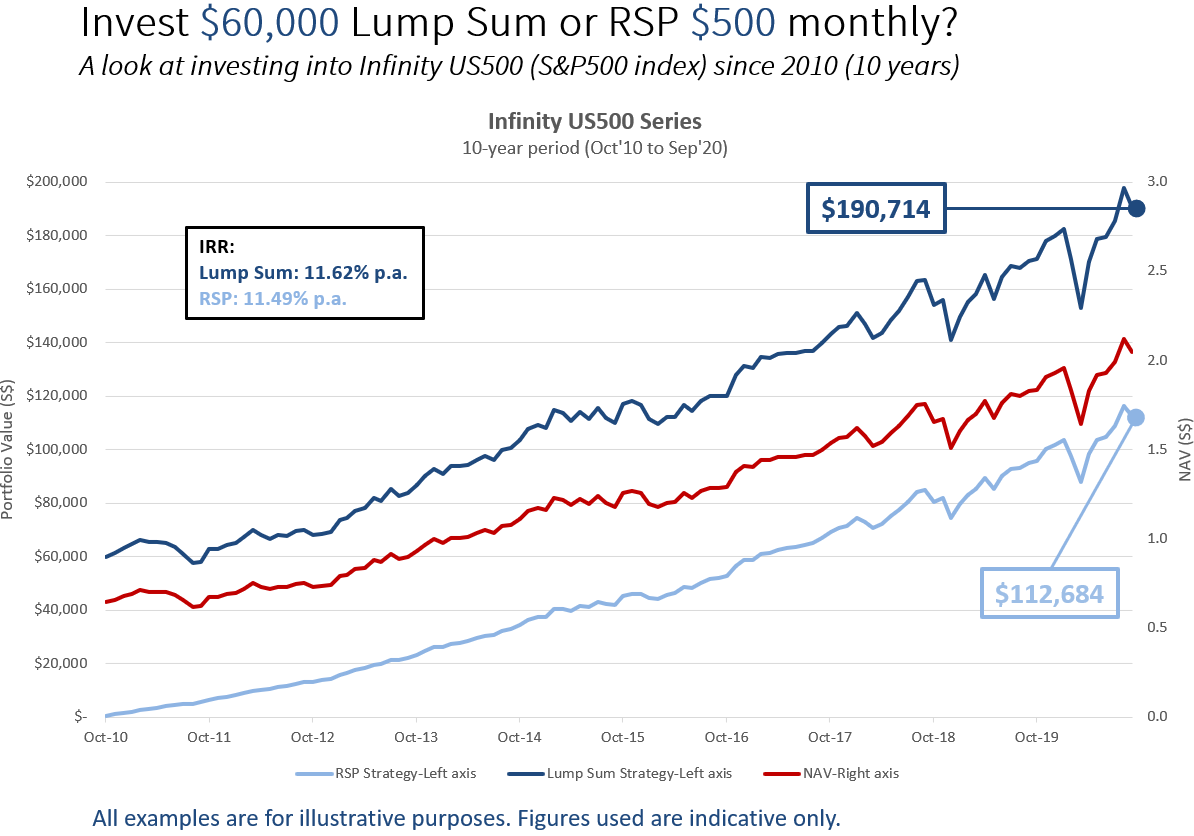

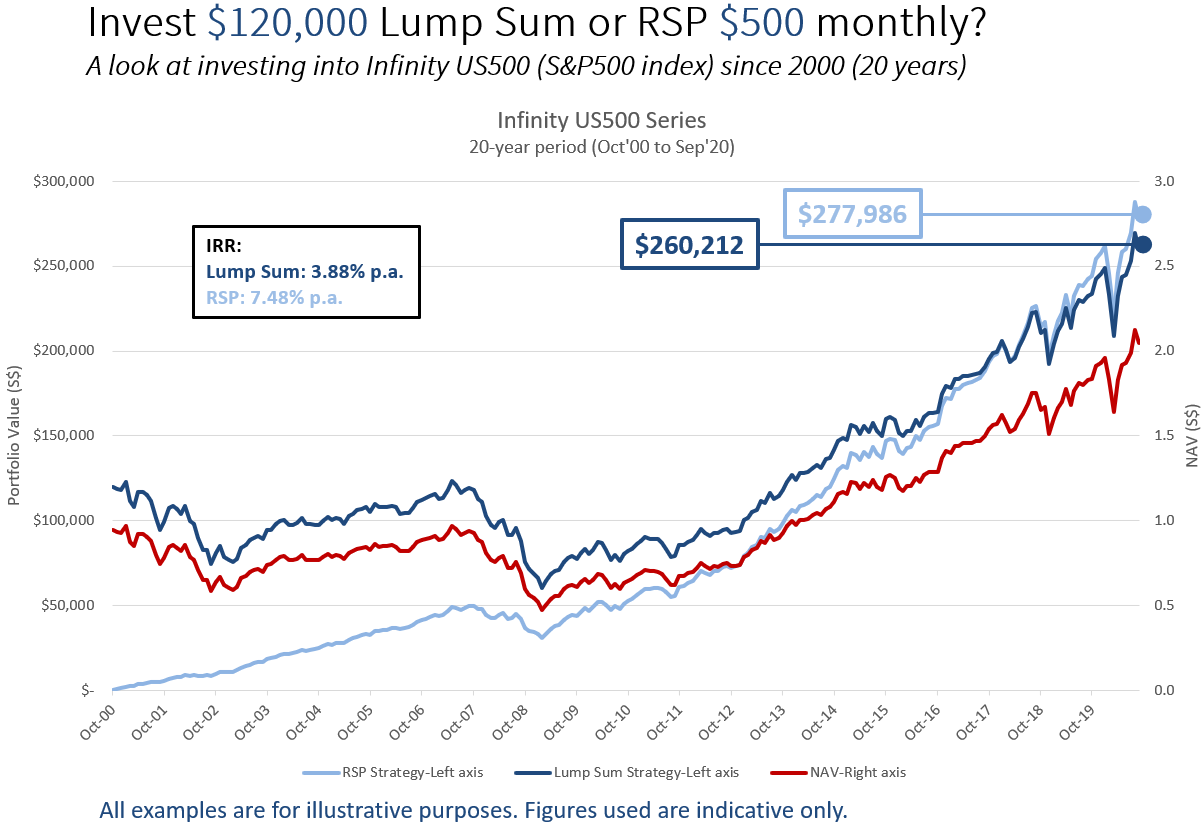

In the charts below, we used real data to compare between investing a lump sum at the beginning of a 10- and 20-year period versus a regular savings plan over the same time frame, into the Infinity US 500 fund, which tracks the S&P500 index.

The results demonstrated that the RSP strategy was superior to lump sum investing across a 20-year period, generating a higher annualized return of 7.48% instead of 3.88% for the investor. In this scenario, the lump sum investor had invested $120,000 as the 2000 dotcom bubble unfolded, endured the 2008 global financial crisis, and only recouped his losses many years later in 2014. Over the same time period, the RSP investor managed to capitalise on the lows of both market crises. A key observation is that the RSP is initially a muted version of the market - rising and detracting lesser than the market at respective economic upturns and downturns - and eventually moving parallel to the markets as wealth builds up.

Even in the 10 years of bull-run since the global financial crisis where markets generally trended upwards, the return on the RSP did not fall too far short of the lump sum investment, gaining 11.49% per annum and 11.62% per annum, respectively.

Summary Complexity Level : Low Effectiveness : Medium to high Success factor : A long-term investment horizon (15 to 20 years) and investing into a fund with long term growth potential.

Strategy #2 – Dollar Value Averaging through a Value Averaging Plan (VAP) While dollar-cost averaging strategies are widely available for investors across various financial institutions, there seems to be little publicity about dollar value averaging and there is perhaps none (other than us, dollarDEX) that offers value averaging strategies.

So what is Value Averaging? The basic idea of value averaging is to invest an amount of money so that the value of your portfolio will meet a pre-determined target value in each period (at the end of each month). In order to meet this target, in some periods you may need to sell some of your holdings, but in dollarDEX’s case, selling from your portfolio will not be triggered, but you will merely be investing lesser in those periods. It was developed in 1988 by Michael Edleson in his book, Value Averaging: The safe and easy strategy for higher investment returns.1

So investors will be investing much more than an equivalent dollar-cost-averaging strategy when prices are lower and investing lesser when prices are higher. This method has been shown to produce higher investor internal rate of return (IRRs) than dollar cost averaging.

What is the difference between RSP and VAP? Value averaging incorporates one crucial information that is absent in dollar cost averaging, and that is the expected rate of return of your investment or known as the target growth rate on dollarDEX.

What are the limitations to VAP? Whether it is dollar-cost or dollar-value averaging, the key benefit of either strategy cannot materialise in the absence of market downturns and volatility.

But we can never bet on the markets to always be this smooth-sailing, can we?

During times of market volatility, however, is when the key benefits of RSP and VAP strategies are maximised, as they double down on declining prices and effectively lower their average buying price whenever the market dips.

Is VAP better than RSP? RSP is revered for its simplicity and ease of implementation, and you will only need to figure out how much money you should put aside every month on a recurring basis and where to channel your money into to kickstart your dollar-cost averaging journey.

Value-averaging through VAP requires you to set aside a range of money for investments on a recurring basis while specifying an appropriate target investment return. Due to the movements of the markets, your monthly investments will vary but fret not, you are able to set maximum limits for your VAP in order not to break the bank.

VAP can be helpful to maintain a disciplined and measured approach to investing by making sure you keep up with the performance of your investments and revisiting how sustainable and achievable your set target returns are.

Setting a target return that is too low is not merely a mismatch to your financial goals, it also leaves you with excess cash that will miss potential growth opportunities. For these reasons, here on dollarDEX, we allow you to take advantage of the continued growth, without having to worry about where to put the excess liquidity derived from outperformance of your portfolio. Your VAP will still be activated on months where your portfolio outperforms at the minimum amount set by you.

In other words, both RSP and VAP are suitable for the medium-to-long-term investors who would like to invest their money regularly in a disciplined manner and is excellent for those who are just starting out and wishes to build their wealth.

You are encouraged to consider the suitability of each method against your financial objectives, investment horizon and most importantly your preference and understand how you are investing. Rather than to pick one over another, why not try a multi-strategy approach? You can start investing with a lump sum and keep some of your reserves for a RSP or VAP over a period of time. Besides cash, dollarDEX also gives you the option to build your RSP and VAP with CPF-OA and SRS assets. To find out more, open a dollarDEX account today! For those who have an account, login to explore our RSP and VAP functions!

Whichever method(s) you choose, don’t forget to also periodically rebalance your investment portfolio to help you assess your overall portfolio performance and review your holdings.

Source: 1 http://www.sigmainvesting.com/advanced-investing-topics/value-averaging

YOU MAY ALSO LIKE THIS

dollarDEX's Disclaimer

All information here is for GENERAL INFORMATION only and does not take into account the specific investment objectives, financial situation or needs of any specific person or groups of persons. Prospective investors are advised to read a fund prospectus carefully before applying for any shares/units in unit trusts. The value of the units and the income from them may fall as well as rise. Unit trusts are subject to investment risks, including the possible loss of the principal amount invested. Investors investing in funds denominated in non-local currencies should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not indicative of future performance. dollarDEX is affiliated with Aviva but dollarDEX does not receive any preferential rates for Aviva products as a result of this relationship. Unit trusts are not bank deposits nor are they guaranteed or insured by dollarDEX. Some unit trusts may not be offered to citizens of certain countries such as United States. Information obtained from third party sources have not been verified and we do not represent or warrant its accuracy, correctness or completeness. We bear no responsibility or liability for any error, omission or inaccuracy or for any loss or damage suffered by you or a third party (including indirect, consequential or incidental damages) arising in any way from relying on this information.

This information does not constitute an offer or solicitation of an offer to buy or sell any shares/units.

Information is correct as of 7/11/2020. |