4 easy steps for a year-end portfolio review

As the streets of Orchard Road start lighting up with Christmas decor and Jingle Bells starts playing at every shopping mall, it's a stark reminder to all of us that the year–end festive season is finally here once again. Amidst all the Christmas shopping, overseas holidays with the kids, clearing your annual leave and catching up with friends over turkey and wine, there is also time to relook at your investment portfolio and perform a stock–take of your finances.

Here we outline 4 simple steps on how to review your portfolio if you already have an investment plan in place, and if you don't, here's how to get started?

Step 1: Review your financial goals

It's always good to begin your review with the question: “Why am I investing?” Whether you're saving for your retirement years down the road or you're already a retiree looking to preserve your capital while generating income for a longer life expectancy, you need to be clear of your investment objective and time horizon to achieve your financial goals.

An example of a clear financial goal could be “I want to accumulate $1 million in 20 years' time for my retirement”. It is quantifiable and has a specific time horizon. Another example could be “I want to generate a monthly dividend income of $5,000 over the next 15 years while preserving my capital”.

If you already penned down your goals before, check if your goals are still aligned now or have they defer along the way.

With your goal set up, you also need to do a stock–take of your existing financials.

Step 2: Assess your current financial situation

Just like how a company reports its annual financial position in the balance sheet, income statement and cashflow statement, the same concept could also be applied to individual investors.

The easiest way to start is to track your income and expenses, from big ticket fixed expenses such as home mortgage payments, car instalments, children's school fees and insurance plans to smaller ticket variable expenses such as groceries, entertainment and vacations. The difference between your monthly or yearly income with your expenses will be your cash surplus or shortfall.

In the ideal scenario, you should have a surplus which adds to your savings and increase your net worth. But if you don't, it is perhaps also time to review your spending habits and be more prudent.

Having a net surplus every month also gives you the option to consider a systematic investment strategy such as a regular savings plan by buying periodically into a unit trust portfolio whether the market goes up or down.

Reviewing your existing assets and debts are also important, such as whether you have excess cash but with too much loan at a high interest rate, or whether you have enough cash liquidity should you suddenly become unemployed or met with unforeseen circumstances.

Step 3: Review asset allocation and investment strategy

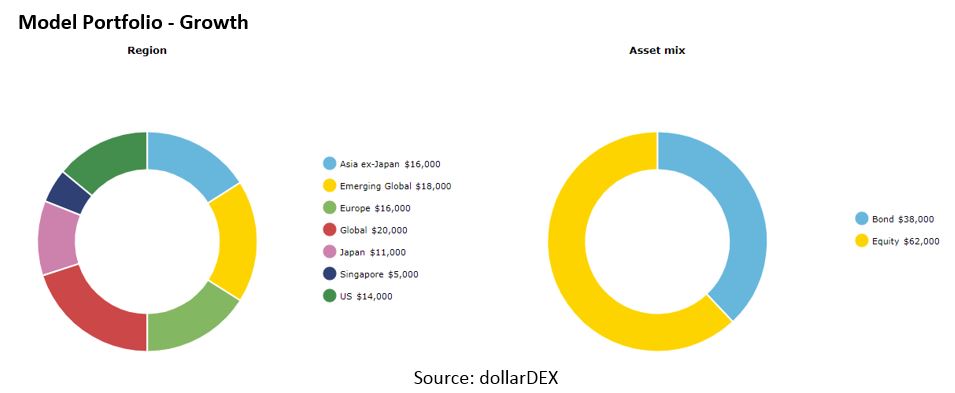

Once you have reviewed your goals and your financial health, turn your attention to how you want to allocate the assets within your portfolio between stocks, bonds and cash based on your risk appetite. If you are unsure of your risk appetite and suitable asset allocation, try our risk profiling questionnaire, which helps you determine if your risk appetite is Conservative, Moderate, Balanced, Growth or Aggressive. A dollarDEX investment portfolio will be matched to suit your risk tolerance.

Here is an example of the asset allocation by asset mix and region if you were a Growth risk profile, where the allocation to equity will be 62% and 38% to bonds.

Take this opportunity to also review your investment strategy in the past year. Have you been successful at “timing” the market as you wanted to? Or perhaps a systematic approach towards investing will work better for you? Are you a growth, balanced or income investor looking at generating dividend income for your retirement? Ask yourself these questions and answer them honestly just like performing a self–appraisal.

Step 4: Assess overall portfolio performance, review individual holdings and rebalance accordingly

Now that you have a clearer picture of your strategy, it's time to review your portfolio performance and compare it against your asset allocation, investment strategy and whether you are on the right track to attain your financial goals.

How much did your portfolio grew or declined since the last time you reviewed? Have you been actively topping up your investments to bring you closer to your goal or are you apprehensive because of the market sentiments and volatility in the market?

It is also timely to check that the movement of the individual holdings do not cause your asset allocation to deviate drastically from your strategy. If it has indeed deviated from your strategy, you should also perform some rebalancing to revert it back.

Finally, it's also timely to consider the macroeconomic environment and see if each holding still makes sense. Are the fundamentals of the sectors or regions that you are invested in still sound? Are the valuations too high and you think it's time to take some profits? Or perhaps you want to capitalize on another sector or region that has a higher growth potential?

A comprehensive review of your investment portfolio takes time and effort, but it is also important as this concerns your overall financial health and desired lifestyle when you retire. So do your future self a favour, dedicate a day off during the year–end holidays, and hopefully, these 4 simple steps could guide you through your DIY investment portfolio review journey.

Merry X'mas & Happy Holidays!

YOU MAY ALSO LIKE

Disclaimer

All information here is for GENERAL INFORMATION only and does not take into account the specific investment objectives, financial situation or needs of any specific person or groups of persons. Prospective investors are advised to read a fund prospectus carefully before applying for any shares/units in unit trusts. The value of the units and the income from them may fall as well as rise. Unit trusts are subject to investment risks, including the possible loss of the principal amount invested. Investors investing in funds denominated in non-local currencies should be aware of the risk of exchange rate fluctuations that may cause a loss of principal. Past performance is not indicative of future performance. dollarDEX is affiliated with Aviva but dollarDEX does not receive any preferential rates for Aviva products as a result of this relationship. Unit trusts are not bank deposits nor are they guaranteed or insured by dollarDEX. Some unit trusts may not be offered to citizens of certain countries such as United States. Information obtained from third party sources have not been verified and we do not represent or warrant its accuracy, correctness or completeness. We bear no responsibility or liability for any error, omission or inaccuracy or for any loss or damage suffered by you or a third party (including indirect, consequential or incidental damages) arising in any way from relying on this information.

This information does not constitute an offer or solicitation of an offer to buy or sell any shares/units.

This article has not been reviewed by the Monetary Authority of Singapore.

Information is correct as of 10/12/2019.