Every parent wants a bright future for his or her child, and most parents believe that the ticket to a bright future is through holistic education, both academically and via extra-curricular activities.

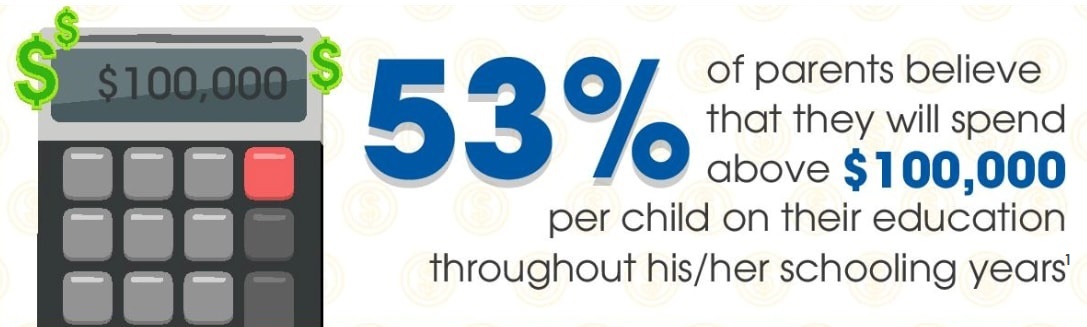

With parents spending hundreds to thousands of dollars each month on their child, there is practically not much savings left at the end of every month, let alone planning for retirement. However, the largest single-ticket item that we have yet to mention is the cost of your child's university degree.

Do you know the inflation rate for the cost of education in Singapore is about 3.6% p.a?2

| Tuition fee for a 4-year degree course at local university3 | ||

| 2009 | 2017 | 2035 |

| About $31,000 | About $41,000 | About $70,0004 |

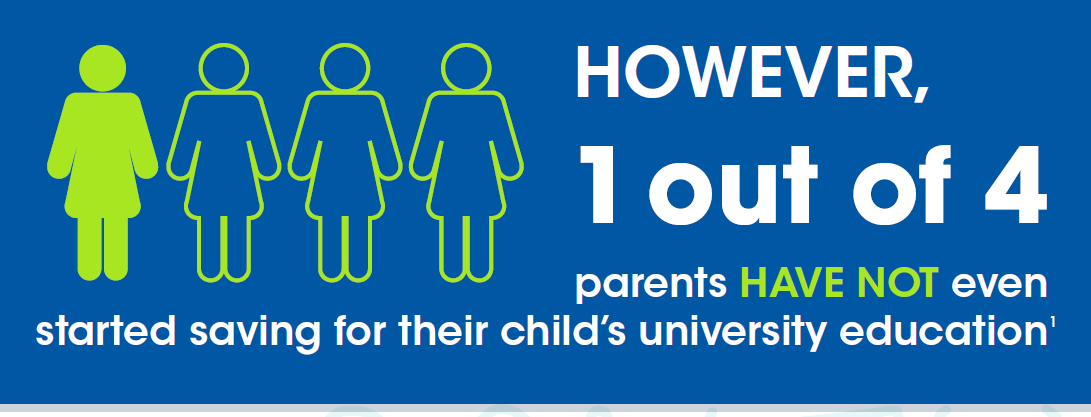

If you've not started planning, don't worry as you are not alone and it is not too late to start now. As parents too, we know how difficult it is to balance between current and future needs amidst the rising cost of living.

Wouldn't it be great to be able to accumulate funds for your child's education by simply starting with as little as $100 a month?

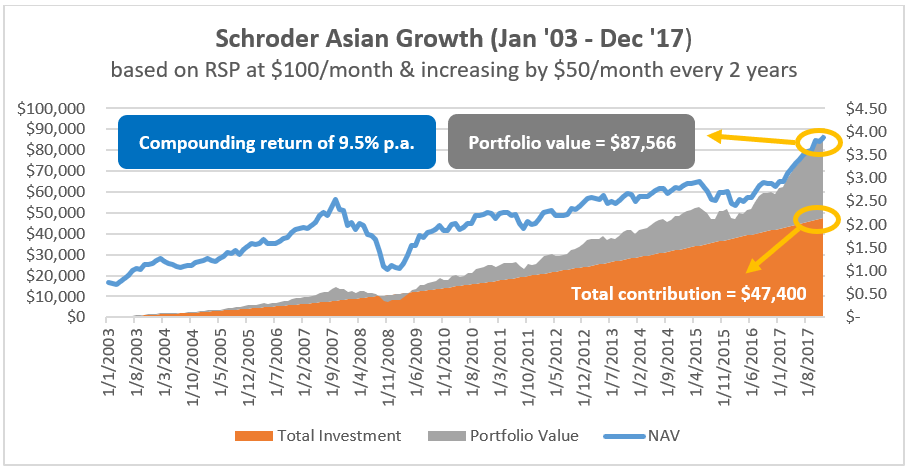

Here's an example, if you start a Regular Savings Plan (RSP) into an Asian Growth fund in 2003 with an initial contribution of $100 a month, and increasing the monthly contributions by $50 every 2 years over a 15-year period, the total contribution from you at the end of 15 years would be $47,400, but your portfolio value would amount to $87,566 based on the fund's performance as shown in the graph below. Your annual compounding return would equate to around 9.5% per annum!

$87,566 is definitely a good amount to supplement or even fully fund your child's degree program. But what if you don't need it when the time comes? You can always continue and use it as your retirement fund!

Based on effects of RSP at $100/month and increasing by $50/month every 24 months against historical price of Schroder Asian Growth fund across

a 15-year period (July '03 to June '18). Figures presented are based on past performance, and is not an indication of future performance.

Growing your savings can be simple and flexible to suit your current commitments. Start with just $100/month in our Regular Savings Plan (RSP) and give your child a head start for their future! Don't delay further as the earlier you start, you will have a longer investment horizon and potentially a higher return too!

YOU MAY ALSO LIKE

Source:

1Results from Asian Parent's survey - Are you saving enough for your child's education?

2https://www.straitstimes.com/singapore/education/all-six-singapore-universities-to-raise-fees

3https://www.diyinsurance.com.sg/portal/articles/html?title=Here%27s+how+much+your+Child%27s+future+University+Education+will+cost+in+Singapore&art_id=54 (based on non-medical degree cost)

4Based on an assumption of 3.6% inflation rate p.a. from 2017 to 2035.