|

Singapore equity market: Once-in-a-decade inflection point By Lion Global Investors 11 May 2021

Market opportunity The Singapore equity market is at a once-in-a decade positive inflection point. Over the last decade, this market underperformed the Asia region as well as the MSCI World Index. However, the risk-reward has now turned favourable. With valuations in price-to-book terms at decade lows, the current juncture presents a rare entry point to gain exposure to the Singapore equity market.

Source: Credit Suisse, January 2021

Near term, we see a few encouraging signs in the equity market. Firstly, we can observe a broadening opportunity set of investible small-medium enterprises (SMEs). After a full decade of underperformance, these surviving companies are likely to emerge into the new decade leaner and with new business models to grow into. Secondly, corporate restructuring in the blue-chip space, such as that of Sembcorp Group and Singapore Airlines, has marked a floor for the market.

Moreover, the Singapore government has backstopped the economy by dipping into the national reserves.

This presents an interesting value proposition for the market as the downside risks are mitigated on one hand, and at the same time, there exists structural growth drivers in the Singapore economy that can bear fruit moving into the next decade.

Cycle of technological development Since the Global Financial Crisis in 2008, the Singapore market underperformed as growth in the Technology sector has been focused in North Asia and the US whilst generally bypassing ASEAN. Meanwhile, Singapore’s economy has also been impacted by China’s slower growth since 2015.

We believe this is about to change. On the technology front, the previous decade 2010 – 2020 has witnessed business-to-consumer (B2C) platform companies such as Amazon, Tencent and Tesla benefit from developments in Big Data. Looking ahead into the next decade towards 2030, we expect technology adoption such as Big Data and 5G connectivity to filter from B2C applications into business-to-business (B2B) and industrial applications.

How Singapore benefits Companies in Singapore are generally positioned as B2B system integration solutions providers, be it in contract manufacturing, semiconductor supply chain, oil and gas and transport. Many of these companies that have survived a decade of weak demand from 2010 – 2020 have strengthened balance sheets and steadily moved up the value chain. Some, such as the company Nanofilm that recently listed in 2020, have succeeded in exponential adoption after two decades of technological gestation.

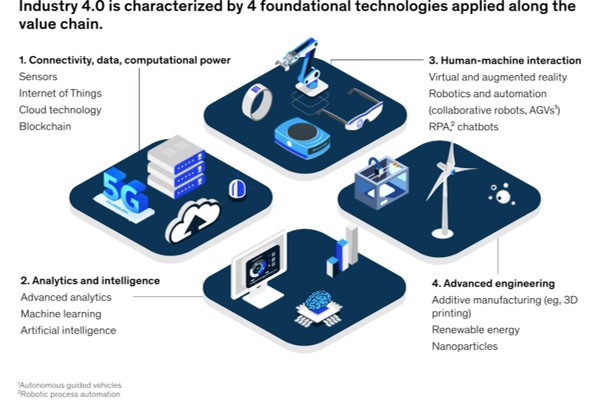

Many others would be able to take advantage of 5G telecommunications technology to embed into their existing products and services, tap into the Electric Vehicle revolution, Life Sciences and Green Infrastructure demand. Industry 4.0, which is the embedding of new technology, digitization and connectivity into traditional companies would be a major structural development for companies in Singapore as technology and use-cases finally converge for B2B solutions providers.

Source: Mckinsey, July 2020

Singapore is also a well-established commodities trading hub. The agricultural commodity cycle, with palm oil being of significance to this region, has been in the doldrums since its peak in 2011. Likewise, the oil and gas and hard commodity cycle has been weak since the decline in oil prices 2015. We expect the supply-demand balance to improve moving forward into the first half of the 2020s decade as there have been limited investments in new supply of soft commodities, oil and gas exploration as well as hard commodities. The global demand for renewed infrastructure development, a political necessity to reflate the real economy after a decade of Quantitative Easing (QE) has led to a widening rich-poor gap across the world, is likely to increase the demand for commodities.

An improving commodities cycle would benefit our banking sector, which offers trade finance to commodities players.

Our Property sector, a bedrock of loans growth in the Singapore banking sector, would also benefit from safe haven flows. Wealth creation from commodities in the ASEAN region typically leads to higher demand for properties in Singapore. Moreover, Singapore remains the premier banking jurisdiction with a British rule of law in the Asian time zone. Singapore stands to continue to benefit from safe haven flows across Asia, both in the wealth management as well as property space.

Key investment highlights In summary, we anticipate that the Singapore Equity market can outperform MSCI World over the next decade because:

One possible way for asset allocators to gain exposure to this dividend plus growth thematic with downside risk mitigation is through the Singapore Dividend Equity Fund. Click here to find out more about the fund.

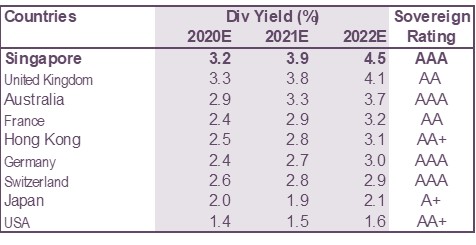

Aggregated by MSCI universe(IBES est.)

Source: Credit Suisse, January 2021 *IBES refers to the Institutional Broker's Estimate System, which is a database of analyst estimates and company guidance for public companies.

YOU MAY ALSO LIKE THIS

Lion Global Investors' Disclaimer For more information on the Singapore Dividend Equity Fund, please refer to https://www.lionglobalinvestors.com/en/funds/lionglobal-singapore-dividend-equity-fund-sgd-class/library.html?fcode=LSDS&fname=LionGlobal%20Singapore%20Dividend%20Equity%20Fund%20SGD%20Class.

You should read the Prospectus and Product Highlights Sheet of the Fund which may be obtained from our website (www.lionglobalinvestors.com) or any of our distributors, consider if the Fund is suitable for you and seek such advice from a financial adviser if necessary, before deciding whether to invest in the Fund. Investments in our funds are subject to investment risks including the possible loss of the principal amount invested. The performance of our funds is not guaranteed and the value of units in our fund and the income accruing to the units, if any, may rise or fall. Past performance, as well as any predictions, projections, or forecasts are not necessarily indicative of the future or likely performance of our funds. The references to any particular company is intended for illustration purposes only and is not indicative of our intention to invest in such company or a recommendation to invest in the securities of such company.

Lion Global Investors® Limited (UEN/ Registration No. 198601745D) |

To continue to serve you better, our system will be undergoing maintenance between 10 PM to 11:59 PM on 25 Apr 2024. During this period, you will not be able to access your dollarDEX account. We apologise for any inconvenience caused.